A new school year has begun and the days already seem to be getting shorter. Soon leaves will turn and change from green to the beautiful colours of fall. Thought will turn to family gatherings and traditions for Thanksgiving, and to costumes and candies for Halloween. But with October upon us, employers must also turn their mind to several changes in the law which directly impact them.

Provincially-Regulated Employers

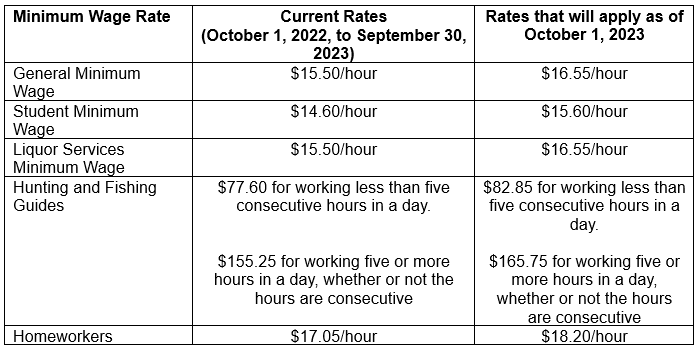

Effective October 1, 2023, the minimum wage in Ontario will increase once again, as it does every October 1st. The increase is tied to, and adjusted in accordance with, the Consumer Price Index for the two preceding calendar years. The October 1, 2023 increase sees the minimum wage rates increase as follows:

If the employer’s regular pay period is split around October 1st (i.e., pay day is October 7th for the period of September 25 to October 7), the pay period will be treated as two pay periods, with the employee being paid at the applicable minimum wage rate for each of those periods.

Employers should also review the compensation received by non-hourly rate employees. Where an employee is paid on a salary basis, or their pay is paid completely or partly on commissions, the level of compensation they receive must still amount to at least the minimum wage rate in effect for each hour the employee has worked. For assistance in answering questions of how to calculate the hourly rate for any such employee, please see the Ministry of Labour’s guide found here.

Federally-Regulated Employers

The federal government has confirmed the following recent changes to the Canada Labour Code (the “Code”), which impact the business for federally-regulated employers:

1. Federally-regulated employers are now required to provide Employee Statements

Under the new section 253.2 of the Code, employers are required to provide Employee Statements to each existing and new employee. The Employee Statement is a document wholly separate from the employee’s written employment agreement, though it may include or duplicate the information set out therein.

The Employee Statement must include the information set out at section 3.1 of the Canada Labour Standards Regulation. For ease of reference, these are:

The names of the parties to the employment relationship;

The job title of the employee and a brief description of their duties and responsibilities;

The address of the ordinary place of work;

The date on which their employment commences;

The term of their employment (fixed term (including start and end date) or permanent/indefinite);

The duration of any probation period;

A description of any required training for the position;

The employee’s hours of work, including information on the calculation of those hours and rules regarding overtime hours

The employee’s wage rate or salary, as well as the rate of overtime pay;

The pay period for their regular wages, as well as the frequency of payment for any other remuneration (i.e., any bonus);

Any mandatory deductions from wages (statutory and otherwise; such as any mandatory LTD or benefit premium deductions); and

Information about how the employee can claim reimbursement of reasonable work-related expenses.

The government has provided an optional template for the Employee Statement. Employee Statements are to be provided to existing employees on or before October 7, 2023. Thereafter, Employee Statements are to be given to new employees within 30 days of their hire. Employee Statements must also be given within 30 days of any change to the terms of employment included in an employee’s previous Employee Statement.

We recommend that employers:

be careful to ensure that nothing in the Employee Statement contradicts the written employment agreement, or any applicable policy (i.e., an Expense Policy);

ensure information regarding any required training or qualifications is consistent with any job posting and written job description for the position;

double-check that any written employment agreement includes clear language that it contains the “entire agreement” between the parties so as to avoid any argument that the Employee Statement sets out additional rights to compensation or benefits, or alters their duties and responsibilities in any way; and

if using the government template, above, or including “additional information” in the Employee Statement, including language which confirms the Employee Statement does not supersede or replace the terms and conditions of the employee’s written employment agreement.

Where there is no written employment agreement, employers will want to ensure the Employee Statement is consistent with the information that has been given to the employee when they were hired or placed into their current role.

Finally, please note that the employer must retain a copy of the Employee Statement during the employee’s employment, and for a further period of 36 months after their employment ends.

2. Reimbursement of Reasonable Work-Related Expenses

Effective July 9, 2023, section 238.1 of the Code has been amended to provide that an employee working in a federally-regulated business is entitled to be reimbursed for reasonable work-related expenses (i.e., work uniforms, travel expenses, training expenses, and equipment needed to perform their duties). To determine whether an expense is a “reasonable work-related expense”, employers should consider each of the factors set out at section 23.1 of the Canada Labour Standards Regulations, including the following:

Is the expense connected to the employee’s performance of work?

Does the expense enable the employee to perform work?

Is incurring the expense required by the employer as a condition of employment/continued employment (i.e., the purchase of a uniform, the completion of a course, obtaining a particular license or certificate not already maintained by the employee)?

Was the expense incurred at the employer’s request, or pre-authorized by the employer?

Is the expense required for the employee’s work under an occupational health or safety standard?

Is the expense one that is normally reimbursed by employers in similar industries?

Has the expense been incurred for a legitimate business purpose, and not for personal use or enjoyment?

The employer is required to reimburse any reasonable work-related expenses within 30 days of the employee submitting their claim for reimbursement/payment unless a written agreement between the employer and employee provides an alternative timeline.

3. Providing Menstrual Products to Employees

Effective December 15, 2023, federally regulated employers will have to make menstrual products to workers in the workplace at no cost. Menstrual products include clean and hygienic tampons and menstrual pads. The products must be in each “toilet room” in the workplace, regardless of gender. Employers are also obligated to provide a covered container for the disposal of menstrual products in each toilet room.

These requirements are set out in the revised section 9.17 of the Canada Occupational Health and Safety Regulations. Further guidance is being developed by the federal Labour Program.

4. New Termination Provisions

New termination provisions under the Code come into effect on February 1, 2024. Under the new provisions, federally-regulated employees will be entitled to graduated notice of termination, or pay in lieu of notice, based on the length of their employment, similar to that of provincially-regulated employees.

Here are some important things to note:

Employees with 3 consecutive months of employment or more will now be entitled to three (3) weeks of notice or pay in lieu of notice (up from 2 weeks) when terminated without cause (subject at all times to the unjust dismissal provisions of the Code for non-managerial employees).

The notice period will increase by one (1) week for each additional completed year of service, up to a maximum of eight (8) weeks.

Employers will be required to provide a written statement of benefits to employees terminated on or after February 1, 2024, setting out the employee’s:

o wages;

o severance pay;

o vacation benefits; and

o any other benefits and pay which may be owing.

The written statement must be provided to the employee on the date of termination or, where working notice is given, no later than two (2) weeks before the employee’s last day of work.

With these changes in mind, we recommend that employers review any template termination documentation to ensure they comply with the new provisions and reference the required benefits statement. In addition, in advance of February 1st, employers should review their existing employment agreements (and any applicable policies) to ensure they provide at least the minimum notice of termination under the revised Code provisions.

5. Proposed Changes – Prohibition on Use of Replacement Workers During a Strike

As part of the 2023 federal budget, the Federal government announced its commitment to introduce legislation by the end of 2023 which would amend the Canada Labour Code to prohibit the use of replacement worker when a unionized federally-regulated employer has locked out employees or in a strike. The proposed amendments would, in part, ban federally-regulated employers with unionized workforces from:

Hiring new replacement employees or contract workers to do the bargaining unit work of striking or locked out employees;

Deploying non-bargaining unit employees (including some managers) to perform bargaining unit work of striking or locked out employees; and

Allowing striking bargaining unit employees the right to cross the picket line and return to work,

except for “conservation purposes,” which are limited to exceptional circumstances to prevent (i) a threat to the life, health or safety of a person; (ii) the destruction, or serious damage, to the employer’s machinery, equipment or premises; or (iii) serious environmental damage to the premises.

The practical impact of such changes would see disruption to the business operations of not only the impacted employer, but also any other provincially or federally-regulated employer that relies on its goods or services.

As always, the lawyers at Piccolo Heath LLP can assist employers with the impact of these legislative changes and we will continue to monitor any changes to the employment legislation.